Multiple Choice

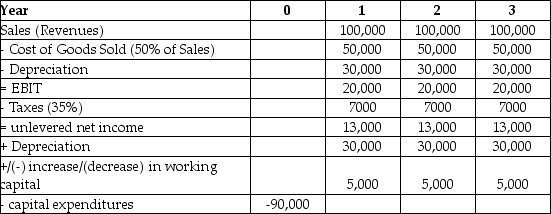

Epiphany Industries is considering a new capital budgeting project that will last for three years. Epiphany plans on using a cost of capital of 12% to evaluate this project. Based on extensive research, it has prepared the following incremental cash flow projects:  The free cash flow for the first year of Epiphany's project is closest to ________.

The free cash flow for the first year of Epiphany's project is closest to ________.

A) $45,600

B) $28,500

C) $38,000

D) $53,200

Correct Answer:

Verified

Correct Answer:

Verified

Q9: Which of the following is an example

Q81: What is the most important function of

Q82: What are sunk costs?

Q84: A firm is considering changing their credit

Q85: An insurance office owns a large building

Q87: If a business owner is using the

Q88: The difference between scenario analysis and sensitivity

Q89: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1316/.jpg" alt=" Visby Rides, a

Q90: Ford Motor Company is considering launching a

Q91: The most difficult part of the capital