Multiple Choice

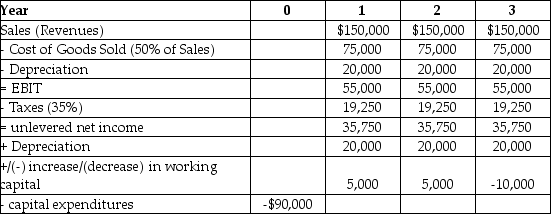

Epiphany Industries is considering a new capital budgeting project that will last for three years. Epiphany plans on using a cost of capital of 12% to evaluate this project. Based on extensive research, it has prepared the following incremental cash flow projects:  The free cash flow for the last year of Epiphany's project is closest to ________.

The free cash flow for the last year of Epiphany's project is closest to ________.

A) $65,750

B) $59,175

C) $49,313

D) $52,600

Correct Answer:

Verified

Correct Answer:

Verified

Q55: An exploration of the effect of changing

Q56: Joe pre-orders a non-refundable movie ticket. He

Q57: What is the correct tax rate that

Q58: Cameron Industries is purchasing a new chemical

Q59: The Sisyphean Corporation is considering investing in

Q61: Use the figure for the question(s) below.

Q62: Which of the following best describes why

Q63: Which of the following statements regarding real

Q64: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1316/.jpg" alt=" Cromwell Industries is

Q65: When evaluating the effectiveness of an improved