Multiple Choice

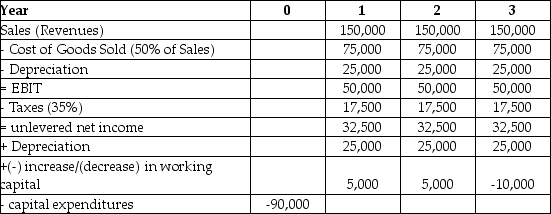

Epiphany Industries is considering a new capital budgeting project that will last for three years. Epiphany plans on using a cost of capital of 12% to evaluate this project. Based on extensive research, it has prepared the following incremental cash flow projects:  The net present value (NPV) for Epiphany's Project is closest to ________.

The net present value (NPV) for Epiphany's Project is closest to ________.

A) $23,387

B) $140,319

C) $46,773

D) $93,546

Correct Answer:

Verified

Correct Answer:

Verified

Q65: When evaluating the effectiveness of an improved

Q66: A small manufacturer that makes clothespins and

Q67: Balance Sheet <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1316/.jpg" alt="Balance Sheet

Q68: Cameron Industries is purchasing a new chemical

Q69: What are project externalities?

Q71: The capital budgeting process begins by _.<br>A)

Q72: A manufacturer of peripheral devices for PCs

Q73: Why does the option to abandon a

Q74: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1316/.jpg" alt=" Massive Amusements, an

Q75: Which of the following adjustments should NOT