Multiple Choice

MACRS

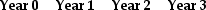

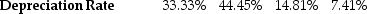

MACRS A machine is purchased for $575,000 and is used through the end of Year 2. The machine will be depreciated using the 3-Year MACRS schedule. At the end of Year 2, the machine is sold for $75,000. What is the after-tax cash flow from the sale of the machine at the end of Year 2 if the firm's marginal tax rate is 35%?

A machine is purchased for $575,000 and is used through the end of Year 2. The machine will be depreciated using the 3-Year MACRS schedule. At the end of Year 2, the machine is sold for $75,000. What is the after-tax cash flow from the sale of the machine at the end of Year 2 if the firm's marginal tax rate is 35%?

A) $42,608

B) $15,916

C) $32,392

D) $63,663

Correct Answer:

Verified

Correct Answer:

Verified

Q9: Which of the following is an example

Q10: Which of the following statements is FALSE?<br>A)

Q11: Vernon-Nelson Chemicals is planning to release a

Q12: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1316/.jpg" alt=" Panjandrum Industries, a

Q13: Which of the following statements is FALSE?<br>A)

Q15: Use the figure for the question(s) below.

Q16: Temporary Housing Services Incorporated (THSI) is considering

Q17: What is the major difference between scenario

Q18: The term "cannibalization" refers to _.<br>A) decrease

Q19: Cameron Industries is purchasing a new chemical