Multiple Choice

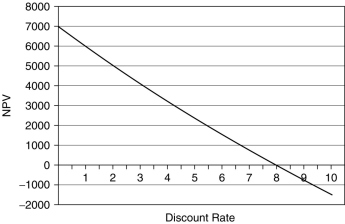

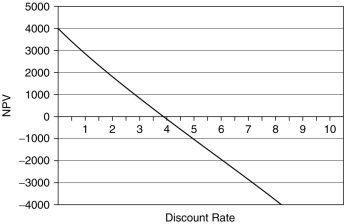

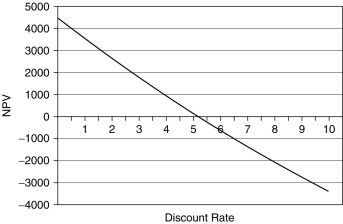

A bakery is deciding whether to buy an extra van to help deliver its products. The van will cost $28,000, but is expected to increase profits by $6,500 per year over the five years of its working life. Which of the following is the correct net present value (NPV) profile for this purchase?

A)

B)

C)

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q90: Consider a project with the following cash

Q91: The internal rate of return (IRR) rule

Q92: A security company offers to provide CCTV

Q93: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1316/.jpg" alt=" If WiseGuy Inc.

Q94: Is there a unique way for calculating

Q96: Internal rate of return (IRR) can reliably

Q97: Trial and error is the only way

Q98: What is the decision criteria using internal

Q99: Consider the following two projects: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1316/.jpg"

Q100: You are offered an investment opportunity that