Multiple Choice

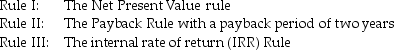

Mary is in contract negotiations with a publishing house for her new novel. She has two options. She may be paid $100,000 up front, and receive royalties that are expected to total $26,000 at the end of each of the next five years. Alternatively, she can receive $200,000 up front and no royalties. Which of the following investment rules would indicate that she should take the former deal, given a discount rate of 8%?

A) Rule I only

B) Rule III only

C) Rule II and III

D) Rule I and II

Correct Answer:

Verified

Correct Answer:

Verified

Q21: Use the information for the question(s) below.

Q22: A delivery service is buying 600 tires

Q23: An auto-parts company is deciding whether to

Q24: A manufacturer of video games develops a

Q25: A security firm is offered $80,000 in

Q28: Which of the following statements is FALSE?<br>A)

Q29: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1316/.jpg" alt=" -An investor is

Q30: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1316/.jpg" alt=" -You are trying

Q31: A company buys a color printer that

Q82: Use the information for the question(s)below.<br>Your firm