Multiple Choice

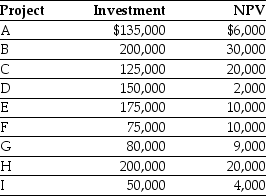

Use the table for the question(s) below.

Consider the following list of projects:

-Assume that your capital is constrained, so that you only have $600,000 available to invest in projects. If you invest in the optimal combination of projects given your capital constraint, then the total net present value (NPV) for all the projects you invest in will be closest to ________.

A) $65,000

B) $80,000

C) $69,000

D) $111,000

Correct Answer:

Verified

Correct Answer:

Verified

Q3: Use the table for the question(s)below.<br>Consider the

Q113: Consider the following two projects: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1316/.jpg"

Q114: Use the table for the question(s) below.<br>Consider

Q115: Which of the following is a disadvantage

Q116: Consider the following two projects: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1316/.jpg"

Q117: An investor has the opportunity to invest

Q119: Tanner is choosing between two investment options.

Q120: Investment A: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1316/.jpg" alt="Investment A:

Q121: A farmer sows a certain crop. It

Q122: Which of the following is NOT a