Multiple Choice

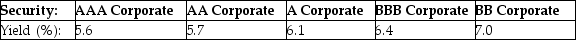

A mining company needs to raise $100 million in order to begin open-pit mining of a coal seam. The company will fund this by issuing 30-year bonds with a face value of $1,000 and a coupon rate of 6.5%, paid annually. The above table shows the yield to maturity for similar 30-year corporate bonds of different ratings. If the company's bonds are rated A, what will be their selling price?

A mining company needs to raise $100 million in order to begin open-pit mining of a coal seam. The company will fund this by issuing 30-year bonds with a face value of $1,000 and a coupon rate of 6.5%, paid annually. The above table shows the yield to maturity for similar 30-year corporate bonds of different ratings. If the company's bonds are rated A, what will be their selling price?

A) $1265.37

B) $1476.27

C) $1054.48

D) $843.58

Correct Answer:

Verified

Correct Answer:

Verified

Q95: Bond traders generally quote bond yields rather

Q96: Use the information for the question(s) below.

Q97: A bond is said to mature on

Q98: A bond has five years to maturity,

Q99: An investor purchases a 30-year, zero-coupon bond

Q101: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1316/.jpg" alt=" The above table

Q102: How can the financial calculator be used

Q103: A bond certificate includes _.<br>A) the terms

Q104: What is the coupon rate of an

Q105: What care, if any, should be taken