Multiple Choice

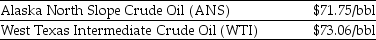

Use the information for the question(s) below.  As an oil refiner, you are able to produce $77 worth of unleaded gasoline from one barrel of Alaska North Slope (ANS) crude oil. Because of its lower sulfur content, you can produce $78 worth of unleaded gasoline from one barrel of West Texas Intermediate (WTI) crude.

As an oil refiner, you are able to produce $77 worth of unleaded gasoline from one barrel of Alaska North Slope (ANS) crude oil. Because of its lower sulfur content, you can produce $78 worth of unleaded gasoline from one barrel of West Texas Intermediate (WTI) crude.

Another oil refiner is offering to trade you  of Alaska North Slope (ANS) crude oil for

of Alaska North Slope (ANS) crude oil for  of West Texas Intermediate (WTI) crude oil. Assuming you currently have

of West Texas Intermediate (WTI) crude oil. Assuming you currently have  of WTI crude, the added benefit (cost) to you if you take the trade is closest to ________.

of WTI crude, the added benefit (cost) to you if you take the trade is closest to ________.

A) ($1550)

B) $1550

C) ($3475)

D) $3475

Correct Answer:

Verified

Correct Answer:

Verified

Q48: Dollar amounts received at different points in

Q49: Costs and benefits must be put in

Q50: Explain the role played by some of

Q51: How can we convert the value of

Q52: Consider the following timeline: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1316/.jpg" alt="Consider

Q54: Whenever a good trades in a competitive

Q55: Which of the following statements is INCORRECT

Q56: You own 1000 shares of Newstar Financial

Q57: Which of the following statements regarding arbitrage

Q58: What is the present value (PV) of