Multiple Choice

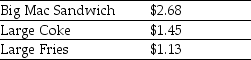

Consider the following prices from a McDonald's Restaurant:  A McDonald's Big Mac value meal consists of a Big Mac sandwich, large Coke, and a large fries. Assume that there is a competitive market for McDonald's food items and that McDonald's sells the Big Mac value meal for $4.59. Does an arbitrage opportunity exists and if so how would you exploit it and how much would you make on one value meal?

A McDonald's Big Mac value meal consists of a Big Mac sandwich, large Coke, and a large fries. Assume that there is a competitive market for McDonald's food items and that McDonald's sells the Big Mac value meal for $4.59. Does an arbitrage opportunity exists and if so how would you exploit it and how much would you make on one value meal?

A) Yes, buy a value meal and then sell the Big Mac, Coke, and fries to make arbitrage profit of $0.67.

B) No, no arbitrage opportunity exists.

C) Yes, buy a Big Mac, Coke, and fries, then sell a value meal to make arbitrage profit of $1.34.

D) Yes, buy a Big Mac, Coke, and fries, then sell a value meal to make arbitrage profit of $0.67.

Correct Answer:

Verified

Correct Answer:

Verified

Q19: What is one of the prerequisite conditions

Q20: Why is the personal decision a financial

Q21: A U.S.-based manufacturer of sunscreen is contemplating

Q22: How can we perform a cost-benefit analysis

Q23: Steve is offered an investment where for

Q25: Which of the following best explains why

Q26: The Law of One Price states that

Q27: What is the future value (FV) of

Q28: If the rate of interest (r) is

Q29: A backhoe can dig 180 feet of