Multiple Choice

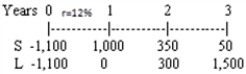

A company is analyzing two mutually exclusive projects, S and L, whose cash flows are shown below:  The company's required rate of return is 12 percent, and it can get an unlimited amount of funds at that rate.What is the IRR of the better project, i.e., the project which the company should choose if it wants to maximize the price of its stock?

The company's required rate of return is 12 percent, and it can get an unlimited amount of funds at that rate.What is the IRR of the better project, i.e., the project which the company should choose if it wants to maximize the price of its stock?

A) 12.00%

B) 15.53%

C) 18.62%

D) 19.08%

E) 20.46%

Correct Answer:

Verified

Correct Answer:

Verified

Q12: Virus Stopper Inc. ,a supplier of computer

Q15: Truck Acquisition<br>You have been asked by the

Q39: Under certain conditions, a particular project may

Q55: The IRR of a project whose cash

Q62: A major disadvantage of the payback period

Q65: Given the following net cash flows, determine

Q81: Normal Projects Q and R have the

Q126: Truck Acquisition<br>You have been asked by the

Q171: An all-equity firm is analyzing a potential

Q181: If the calculated NPV is negative,then which