Multiple Choice

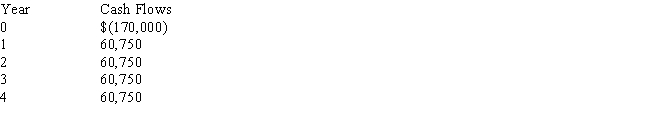

Union Atlantic Corporation, which has a required rate of return equal to 14 percent, is evaluating a capital budgeting project that has the following characteristics:  Union Atlantic's capital budgeting manager has determined that the project's net present value is $7,008.According to this information, which of the following statements is correct?

Union Atlantic's capital budgeting manager has determined that the project's net present value is $7,008.According to this information, which of the following statements is correct?

A) The project's internal rate of return (IRR) must be greater than 14 percent.

B) The project's discounted payback must be less that its economic life.

C) The project should be purchased by Union Atlantic.

D) All of these statements are correct.

E) None of these statements is correct.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: The future value of a cash flow

Q6: There exists an IRR solution for each

Q10: Supposed someone offered you the choice of

Q20: You are given the following cash flow

Q61: Assume that you inherited some money.A friend

Q68: Suppose an investor can earn a steady

Q74: You want to buy a Nissan 300ZX

Q95: You have just taken out an installment

Q130: South Penn Trucking is financing a new

Q131: Bank One currently charges a 10 percent