Essay

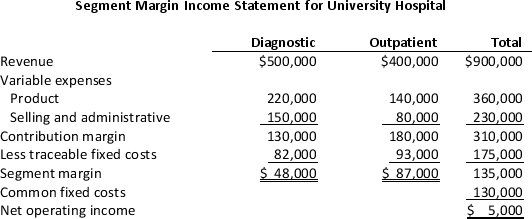

University Hospital provided the following income statement for two of its divisions: Diagnostic and Outpatient.Both divisions are structured as investment centers.

The average assets for Diagnostic and Outpatient divisions total $400,000 and $600,000,respectively.The required minimum rate of return for both divisions is 10%.

The average assets for Diagnostic and Outpatient divisions total $400,000 and $600,000,respectively.The required minimum rate of return for both divisions is 10%.

Required:

a.Calculate the current residual income for each division.

b.Why is residual income a better measure of performance for managers of investment centers than the overall profit compared to the flexible budget?

Correct Answer:

Verified

a.Residual income calculations: Diagnost...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q15: Finance theory says that the rate of

Q50: A cost center manager's performance is measured

Q64: In calculating EVA, invested capital is the

Q66: The organizational structure in which decision-making authority

Q110: The Sphinx division of Shepherd Corporation generated

Q112: Which of the following is the most

Q116: Chute Company's Extract division has collected the

Q118: In calculating ROI,the return on investment is

Q138: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB3446/.jpg" alt=" -In a decentralized

Q181: Jumbo Industries is considering the purchase of