Essay

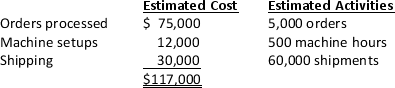

Jones Manufacturing Company makes two products.The company's budget includes $500,000 of overhead.In the past,the company allocated overhead based on estimated total direct labor hours of 20,000.Jones recently implemented an activity-based costing system and had determined that overhead can be broken into three overhead pools: processed purchase orders,machine setups,and good shipped.The following is a summary of company information:

Required:

Required:

a.Calculate the company's overhead rate based on total direct hours.

b.Calculate the company's overhead rates using the activity-based costing pools.

Unit 7-2,

Correct Answer:

Verified

a.$500,000/20,000 = $25 per di...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q24: A difference in GAAP-based product costing and

Q26: Which of the following characteristics relate to

Q27: In an activity-based costing system,after the manufacturing

Q28: Schwynn Inc.manufactures street bicycle tires and mountain

Q30: Dawson Company manufactures two products,Regular and Deluxe.Overhead

Q31: With activity-based costing,the goal is to<br>A)develop a

Q32: The following list includes activities that are

Q33: Which of the following is a way

Q88: The categories of activities that are required

Q143: A simple ABC model can have fewer