Essay

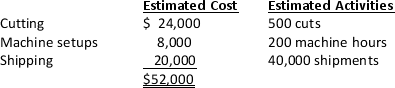

Clover Manufacturing Company makes two products.The company's budget includes $200,000 of overhead.Using the traditional allocation method,the company has allocated overhead based on estimated total direct labor cost of $125,000.Clover recently implemented an activity-based costing system and had determined that overhead can be broken into three overhead pools: cutting,machine setups,and good shipped.The following is a summary of company information:

Required:

Required:

a.Calculate the company's overhead rate as a percentage of direct labor cost.

b.Calculate the company's overhead rates using the activity-based costing pools.

Unit 7-2,

Correct Answer:

Verified

a.$200,000/$125,000 = 160% of ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q44: Processing a sales order is an example

Q68: Since a batch-level activity is based on

Q69: In the activity identification stage of implementing

Q71: In implementing an activity-based costing system,after all

Q74: Place an "X" in the column that

Q76: Stockin Company produces Tablets and Books.Total overhead

Q77: Angora,Inc.uses activity-based costing to cost its two

Q91: A characteristic of non-value-added activities is that

Q132: Those activities that create the product the

Q157: Process improvement is the examination of business