Multiple Choice

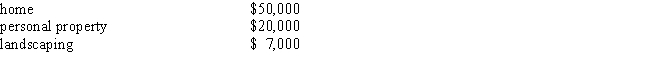

Carl and Alexandra purchased a $200,000 homeowners policy for their house in 1988.They have renewed the policy each year since and have replacement coverage.This policy has a $1,000 deductible.Their home now has a replacement value of $275,000.Last week they came home to find a small fire which caused the following damages: Assume Carl and Alexandra have a standard HO-3 policy with personal property covered at 50% and landscaping covered for 10%.How much will the insurance pay for the losses of their personal property and landscaping?

A) $15,000

B) $ 9,700

C) $24,545

D) $27,000

E) $30,000

Correct Answer:

Verified

Correct Answer:

Verified

Q10: Which of the following best describes the

Q11: Premium discounts may result from:<br>A) safe driving

Q11: Protection for personal property both at home

Q12: Donna,who is single and 30-years-old,has received several

Q14: For an extra premium,the HO-3 homeowner's policy

Q15: You could save money on your car

Q28: INSTRUCTIONS: Choose the word or phrase in

Q66: An automobile covered under a policy with

Q92: The principle of indemnity states that the

Q129: Choose the word or phrase in [