Multiple Choice

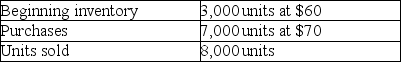

Given the following data,by how much would taxable income change if FIFO is used rather than LIFO?

A) Decrease by $20,000

B) Decrease by $19,000

C) Increase by $20,000

D) Increase by $19,000

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q22: Dole Company uses the periodic inventory system.At

Q23: Blue Company has the following data for

Q25: Which is the CORRECT order for items

Q26: Which of the following is NOT used

Q32: Steve's Hardware Store uses the perpetual inventory

Q33: A fire destroyed the inventory of Barber

Q59: Under the average-cost inventory method,to determine the

Q102: Since a perpetual inventory system continuously updates

Q135: For discount retailers such as Walmart,inventory turnover

Q140: The gross profit percentage is calculated as:<br>A)cost