Essay

The following information is available for George Company at March 31:

• Adjusted bank balance as of March 31 was $6,450.

• Outstanding checks totaled $850.

• A customer's check for $260 was returned due to nonsufficient funds.

• March's service charge was $25.

• Bank collected an account receivable of $1,550.

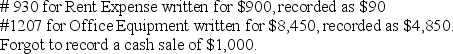

• A new bookkeeper had the following errors:

• A deposit was shown on the bank statement as $965,when the deposit ticket was correctly totaled to be $695.

• A deposit was shown on the bank statement as $965,when the deposit ticket was correctly totaled to be $695.

• Deposits made at month-end totaled $4,516; these were not shown on bank statement.

Prepare a bank reconciliation to determine:

(1)the balance per bank at March 31 before any reconciling items,

(2)the balance in the Cash account at March 31 before any reconciling items.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: _ rearranges messages by a mathematical formula

Q12: In a bank reconciliation,items recorded by the

Q24: An imprest petty cash fund of $600

Q25: The following pertains to Carlisle Company:<br>1.Balance per

Q27: In a bank reconciliation,a NSF check is:<br>A)added

Q31: Gia Company has the following information available:

Q33: What are some examples of fraudulent financial

Q34: External auditors are responsible for maintaining the

Q38: A petty cash fund:<br>A)is established to pay

Q54: The book side of a bank reconciliation