Essay

The information below was used to prepare a bank reconciliation for Lorena Company at October 31:

• According to the bank statement,the bank balance as of October 31 was $8,765.According to the books,the cash balance as of October 31 is $9,557.

• Outstanding checks totaled $1,433.

• A customer's check for $999 was returned for NSF.

• October's service charge was $100.

• Bank collected $1,600 from a customer of Lorena Company in payment of a note receivable,including interest of $100.

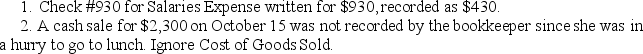

• A new bookkeeper had problems posting checks and recording cash receipts:

• A deposit was made by the company for $900.This was the correct amount,however,the bank made a mistake and recorded the deposit as $890.

• A deposit was made by the company for $900.This was the correct amount,however,the bank made a mistake and recorded the deposit as $890.

• Deposits made at month-end totaled $4,516; these were not shown on the bank statement.

Required:

1.Prepare the bank reconciliation at October 31.

2.Prepare the journal entries at October 31.

Correct Answer:

Verified

Correct Answer:

Verified

Q3: The person performing the bank reconciliation should

Q5: The bookkeeper recorded a payment on account

Q9: A company receives customer checks in the

Q10: Olde Shoppe has the following information at

Q11: Marjorie Company's cash balance per the books

Q29: Debit cards are being used:<br>A)in place of

Q65: A bank reconciliation included an outstanding check

Q79: _ is the element in the fraud

Q132: The objectives of internal control do NOT

Q150: Which of the following items can be