Multiple Choice

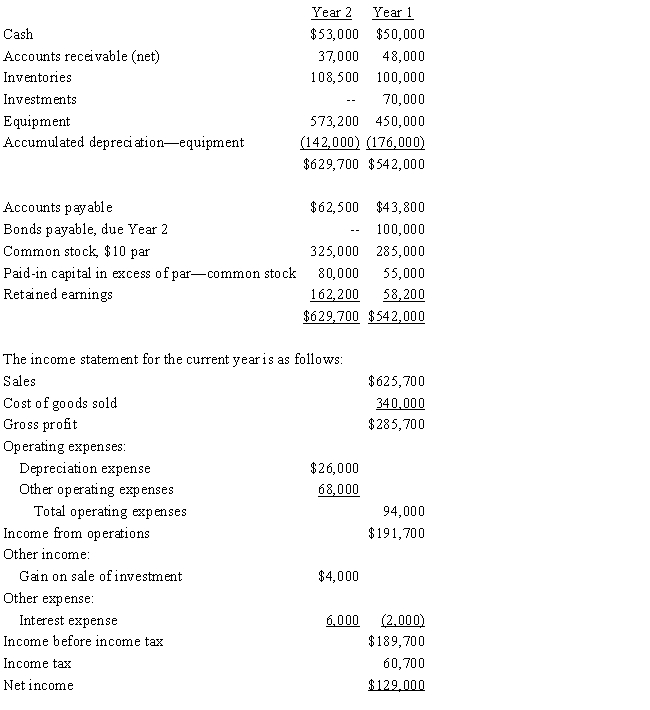

The comparative balance sheets of Posner Company, for Years 1 and 2 ended December 31, appear below in condensed form:

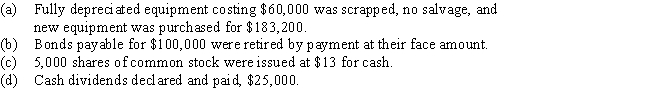

Additional data for the current year are as follows:

What are the net cash flows from operating, investing, and financing activities for Year 2?

A) operating: $108,000; investing: ($105,200) ; financing: ($60,000)

B) operating: $151,800; investing: ($84,200) ; financing: ($64,600)

C) operating: $122,200; investing: ($84,200) ; financing: ($35,000)

D) operating: $172,200; investing: ($109,200) ; financing: ($60,000)

Correct Answer:

Verified

Correct Answer:

Verified

Q27: Which of the following should be added

Q38: Free cash flow is the measure of

Q40: On the basis of the following data

Q46: The last item on the statement of

Q47: The statement of cash flows is not

Q47: On the statement of cash flows prepared

Q51: Identify the section of the statement of

Q57: A cash flow per share amount should

Q107: If land costing $145,000 was sold for

Q121: Use the information below for Washington Company