Essay

Carter Co. acquired drilling rights for $18,550,000. The oil deposit is estimated at 74,200,000 gallons. During the current year, 6,000,000 gallons were drilled. Journalize the adjusting entry at December 31 to recognize the depletion expense.

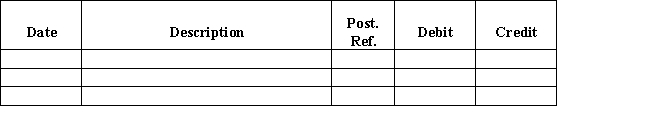

Journal

Correct Answer:

Verified

_TB2281_00

_TB2281_00

*Depletion rate = Cost/Esti...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

*Depletion rate = Cost/Esti...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q57: Which of the following is true?<br>A) If

Q58: Determine the depreciation, for the year of

Q63: Journalize each of the following transactions:

Q65: Falcon Company acquired an adjacent lot to

Q70: Expenditures that add to the utility of

Q74: The cost of a patent with a

Q113: A fixed asset with a cost of

Q148: Match the intangible assets described with their

Q169: On April 15, Compton Co. paid $2,800

Q218: Classify each of the following as:<br>-Fixing damage