Multiple Choice

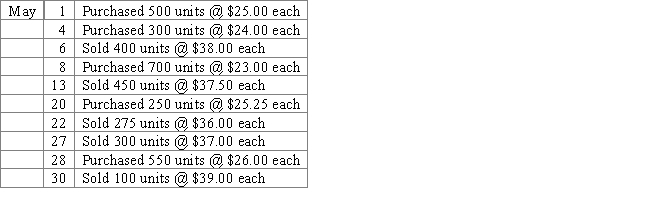

Brutus Corporation, a newly formed corporation, has the following transactions during May, its first month of operations.

-Using the table provided, calculate total sales, cost of goods sold, gross profit, and ending inventory using each of the average cost periodic inventory method. Round the average to the nearest cent.

A) Total sales: $56,975.00

Cost of goods sold: $36,431.25

Gross profit: $20,543.75

Ending inventory: $19,981.2

B) Total sales: $56,975.00

Cost of goods sold: $36,587.50

Gross profit: $20,387.50

Ending inventory: $19,825.00

C) Total sales: $56,975.00

Cost of goods sold: $37,312.50

Gross profit: $19,662.50

Ending inventory: $19,573.25

D) Total sales: $56,975.00

Cost of goods sold: $37,401.75

Gross profit: $19,573.25

Ending inventory: $19,010.75

Correct Answer:

Verified

Correct Answer:

Verified

Q53: Beginning inventory, purchases, and sales for an

Q54: Complete the chart, indicating whether LIFO or

Q55: During the taking of its physical inventory

Q56: On the basis of the following data,

Q57: Match each description to the appropriate cost

Q59: Match each description to the appropriate document

Q60: Under the periodic inventory system, a physical

Q61: If a fire destroys the inventory, the

Q62: The following data were taken from Castle,

Q63: On the basis of the following data