Essay

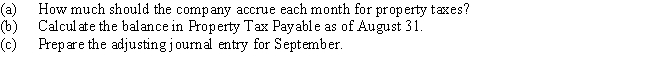

On January 1, the Newman Company estimated its property tax to be $5,100 for the year.

Correct Answer:

Verified

(a) $425 ($5,100/12)...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

(a) $425 ($5,100/12)...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Related Questions

Q24: Deferred revenue is revenue that is<br>A) earned

Q70: Unearned revenue is a liability.

Q76: By ignoring and not posting the adjusting

Q95: Data for an adjusting entry described as

Q191: The following adjusting journal entry found in

Q192: For each of the following, journalize the

Q194: What is the purpose of the adjusted

Q197: The supplies account had a beginning balance

Q198: The entry to adjust for the cost

Q200: Which of the following accounts would likely