Essay

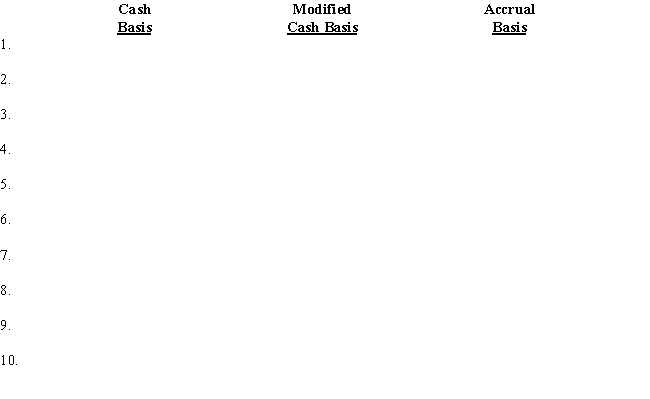

In the columns below,insert the entry that would be made for each transaction under each accounting basis,using appropriate debit and credit account titles.

1. Performed services on account.

2. Supplies are partly used.

3. Purchased one-year insurance policy for cash.

4. Received bill for electricity.

5. Depreciation on equipment.

6. Purchased equipment on account.

7. Paid cash for wages.

8. Paid for equipment purchased on account.

9. Performed services for cash.

10. Paid cash for new equipment.

Correct Answer:

Verified

Correct Answer:

Verified

Q46: Match the terms with the definitions.<br>-The cost

Q47: A contra-asset has a credit balance.

Q48: The formula to calculate straight-line depreciation is

Q49: Plant assets provide benefits over a long

Q50: A fiscal year is always the same

Q52: The Income Statement and Balance Sheet columns

Q53: A 12-month fiscal year can end on

Q54: Owner's equity at the start of the

Q55: The third pair of columns on a

Q56: The work sheet columns that show the