Essay

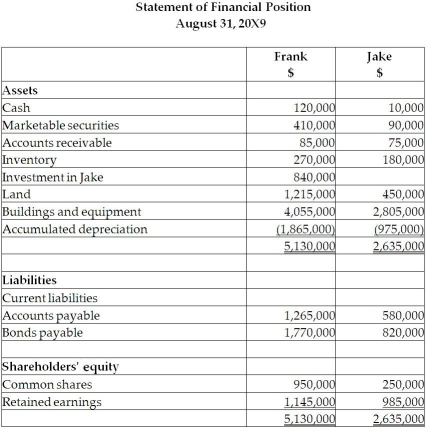

On September 1, 20X5, Frank Limited decided to buy 70% of the shares outstanding of Jake Inc. for $840,000. Frank paid for this acquisition by using cash of $500,000 and marketable securities for the remaining amount. The balances showing on the statement of financial position for the two companies at August 31, 20X5, are as follows:  After a review of the financial assets and liabilities, Frank determines that some of the assets of Jake have fair values different from their carrying values. These items are listed below:

After a review of the financial assets and liabilities, Frank determines that some of the assets of Jake have fair values different from their carrying values. These items are listed below:

• Inventory has a fair value of $130,000.

• The building has a fair value of $1,090,000. The remaining useful life of the building is 20 years.

• A customer list has a fair value of $200,000. The trademark is estimated to have a useful life of 10 years.

• The bonds payable have a fair value of $720,000 and are due on August 31, 20X9.

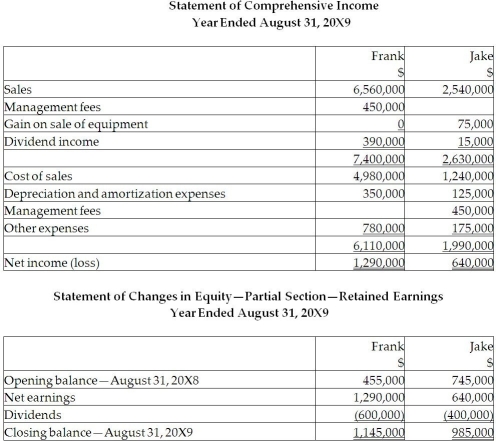

During the 20X9 fiscal year, the following events occurred:

1. Frank sold merchandise to jake for . Profit margin on these sales . Jake still has Inventory on hand of . Included in the opening inventory of Jake for is merchandise purchased from Frank in for . The gross profit mar gin on these sales was

2. Jake sold merchandise to Frank for . The gross margin on these sales was . At the end of the year, of this was still in Frank's inventory. Included in the opening inventory of Frank for was merchandise purchased from Jake in for . The profit margin on these sales was .

3. During , Jake sold to Frank equipment resulting in a gain to Jake of . At the time, the original cost and accumulated depreciation to date for the equipment on the Jake's books were and 160,000 . The remaining useful life for this equipment is 15 years. Depreciation is fully recorded in the year of purchase and no depreciation is recorded in the year of disposal by both companies.

4. During , Jake paid management fees of to Frank.

5. During 20X9, lake paid dividends of and Frank paid dividends of .

Required:

Required:

Calculate the balance in the investment in Jake account at August 31, 20X9, if the company accounted for this subsidiary using the equity basis.

Calculate the balance in the investment in Jake account at August 31, 20X9, if the company accounted for Jake as an associate using the proprietary theory basis for the equity method.

Explain the difference between the two balances.

Goodwill is determined using the parent-company extension approach.

Correct Answer:

Verified

Eliminate intercompany transactions for...

Eliminate intercompany transactions for...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q18: Tooker Co. acquired 80% of the outstanding

Q19: Chandler Ltd. owns 65% of Stork Co.

Q20: Linville Ltd. owns 80% of the outstanding

Q21: TLC Homecare Ltd. owns 100% of Errand

Q22: Mallard Ltd. acquired 75% of the outstanding

Q24: Fox Co. acquired 60% of Sox

Q25: Farm owns 70% of the common shares

Q26: On September 1, 20X5, Hot Limited decided

Q27: Bowen Limited purchased 60% of Sloch

Q28: Roslynn Ltd. is a subsidiary of Goodale