Multiple Choice

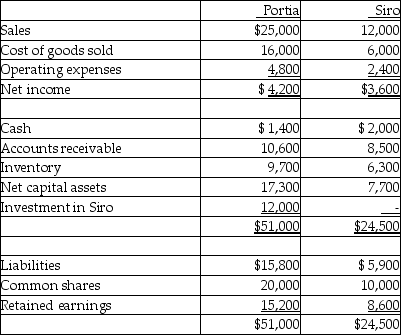

Portia Ltd. acquired 80% of Siro Ltd. on December 31, 20X0. At the acquisition date, Siro's net assets totalled $15,000. Portia uses the cost method to record the acquisition and consolidates using the entity method. At December 31, 20X1, the separate-entity financial statements showed the following:

- During 20X1, Siro sold $7,000 of goods, with a gross margin of 40%, to Portia. At the end of 20X1, $3,000 of the goods were still in Portia's inventory. What portion of consolidated net income for 20X1 is attributable to Portia?

A) $6,120

B) $6,240

C) $6,600

D) $7,080

Correct Answer:

Verified

Correct Answer:

Verified

Q26: Portia Ltd. acquired 80% of Siro Ltd.

Q27: Olthius Ltd. purchased 60% of Fredo Ltd.

Q28: On December 31, 20X6, the balance

Q29: On December 31, 20X2, Bates Ltd.

Q30: Bates Ltd. owns 60% of the

Q32: On December 31, 20X6, the statements

Q33: A parent company chooses to acquire only

Q34: Taguchi Ltd. owns 80% of Shag

Q35: Under IAS 27, where does the non-controlling

Q36: Arnez Ltd. acquired 70% of Bedard Ltd.