Multiple Choice

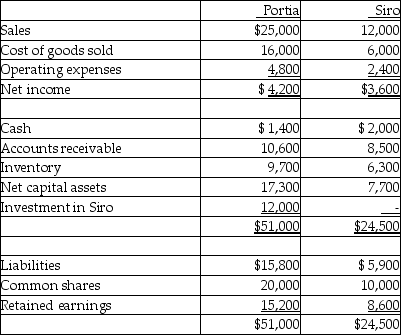

Portia Ltd. acquired 80% of Siro Ltd. on December 31, 20X0. At the acquisition date, Siro's net assets totalled $15,000. Portia uses the cost method to record the acquisition and consolidates using the entity method. At December 31, 20X1, the separate-entity financial statements showed the following:

- During 20X1, Siro sold $7,000 of goods, with a gross margin of 40%, to Portia. At the end of 20X1, $3,000 of the goods were still in Portia's inventory. What is Portia's consolidated cost of goods sold for 20X1?

A) $13,800

B) $16,200

C) $16,800

D) $22,000

Correct Answer:

Verified

Correct Answer:

Verified

Q1: There are alternative ways to calculate consolidated

Q2: In preparing consolidation working papers, why is

Q4: Jordan Ltd. acquired 80% of Cool Co.

Q5: Bates Ltd. owns 60% of the

Q6: Under the parent-company extension method, to which

Q7: Devon Ltd. acquired 90% of Luka Ltd.

Q8: What is the purpose of showing an

Q9: Which of the following statements is true

Q10: Pooke Co. acquired 75% of Finch Ltd.

Q11: On September 1, 20X5, High Limited