Essay

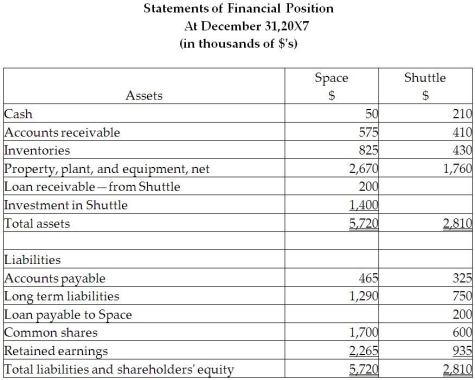

On December 31, 20X5, Space Co. purchased 100% of the outstanding common shares of Shuttle Ltd. for $1,200,000 in shares and $200,000 in cash. The statements of financial position of Space and Shuttle immediately before the acquisition and issuance of the notes payable were as follows (in 000s):

The difference in the carrying value and the fair value of the capital assets for Shuttle relates to its office building. This building was originally purchased by Shuttle in January 20X1 and is being depreciated over 30 years.

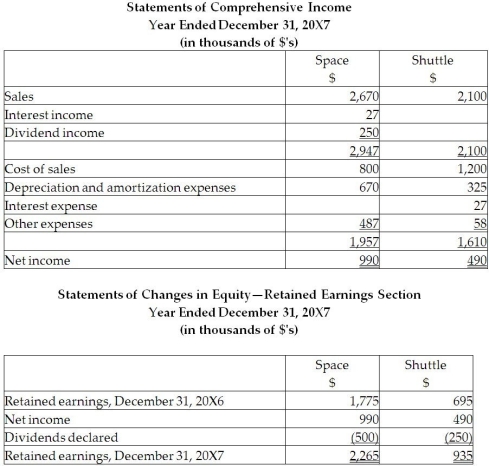

During 20X6, the year following the acquisition, the following occurred:

1. Shuttle borrowed $350,000 from Space on June 1, 20X6, and was charged interest at 10% per annum, which it paid on a monthly basis. There were no repayments of principal made during the remainder of the year.

2. Throughout the year, Space purchased merchandise of $800,000 from Shuttle. Shuttle's gross margin is 35% of selling price. At December 31, 20X6, Shuttle still owed Space $250,000 on this merchandise; 60% of this merchandise was resold by Space prior to December 31, 20X6.

3. Shuttle paid dividends of $250,000 at the end of 20X6 and Space paid dividends of $500,000.

During 20X7, the following occurred:

1. Shuttle paid $150,000 on the loan payable to Space on May 30, 20X7.

2. Throughout the year, Space purchased merchandise of $900,000 from Space. Space's gross margin is 35% of selling price. At December 31, 20X6, Shuttle still owed Space $350,000 on this merchandise; 80% of this merchandise was resold by Shuttle prior to December 31, 20X7.

3. The goodwill was tested and found to be impaired, resulting in an impairment loss of $120,000.

4. Shuttle paid dividends of $250,000 at the end of 20X7 and Space paid dividends of $500,000.

Required:

Required:

Calculate the consolidated retained earnings for Space as at December 31, 20X7.

Prepare the consolidated statement of financial position for the year ended December 31, 20X7, for Space.

Correct Answer:

Verified

Correct Answer:

Verified

Q27: On December 31, 20X2, Pipe Ltd.

Q28: A subsidiary sold goods to its

Q29: Mitzi's Muffins Ltd. purchased a commercial baking

Q30: Thivan Ltd. is a wholly-owned subsidiary

Q31: Flatt Ltd. is a wholly-owned subsidiary of

Q33: Inventory was acquired as part of a

Q34: In consolidating a wholly owned parent-founded subsidiary,

Q35: On December 31, 20X1, Dad Ltd.

Q36: A company has a subsidiary that has

Q37: Waite Co. is a wholly-earned subsidiary