Essay

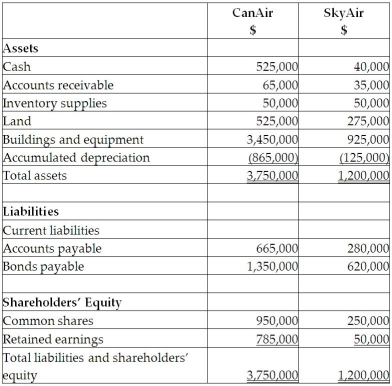

On September 1, 20X5, CanAir Limited decided to buy 100% of the shares outstanding of SkyAir Inc. for $900,000. CanAir will pay for this acquisition by using cash of $500,000 and issuing share capital for the remaining amount. The balances showing on the statement of financial position for the two companies at August 31, 20X5, are as follows:  After a review of the financial assets and liabilities, CanAir determines that some of the assets of SkyAir have fair values different from their carrying values. These items are listed below:

After a review of the financial assets and liabilities, CanAir determines that some of the assets of SkyAir have fair values different from their carrying values. These items are listed below:

• Land has a fair value of 225,000.

• The building has a fair value of $1,090,000. (The company does not own any equipment.)The remaining useful life of the building is 20 years.

• Internet domain name has a fair value is $55,000. The domain name is estimated to have a useful life of five years.

• Customer lists have a fair value is $35,000. It is estimated that the customer lists will have a useful life of seven years.

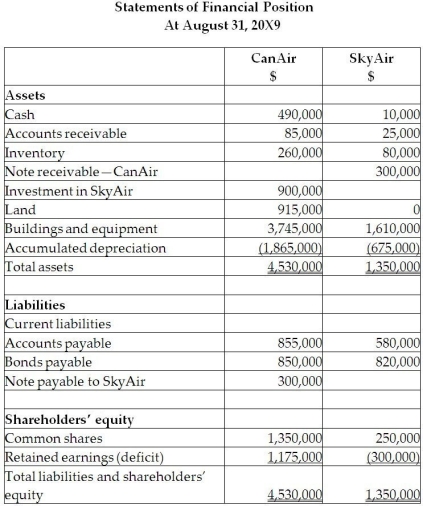

During the 20X9 fiscal year, the following events occurred:

1. On March 1, 20X9, SkyAir sold land to CanAir for $390,000, which had a carrying value of $275,000. CanAir paid for this with $90,000 cash and a note payable for the difference. This note pays interest at 10%, which is paid monthly.

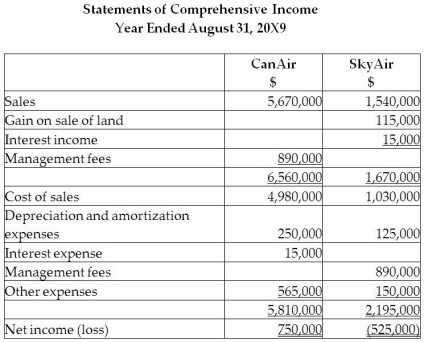

2. CanAir provided management expertise to SkyAir and charged management fees of $890,000.

3. CanAir sold supplies (included in CanAir sales)to SkyAir for $200,000. CanAir charged SkyAir an amount that was 25% above cost. SkyAir still has supplies on hand of $70,000.

4. In 20X8, SkyAir provided seat space on flights to CanAir for a value of $500,000. This amount was included in sales for SkyAir. Profit margin on these sales is 40%. At the end of August, 20X8, CanAir still had an amount of $200,000 in these prepaid seats that had not yet been used. (CanAir includes this in inventory.)

Required:

Required:

Prepare the consolidated statement of comprehensive income for the year ended August 31, 20X9.

Correct Answer:

Verified

Correct Answer:

Verified

Q3: On January 1, 20X3, Dwayne Ltd.

Q4: Mitzi's Muffins Ltd. purchased a commercial baking

Q5: Which of the following statements about goodwill

Q6: On December 31, 20X5, Space Co.

Q7: On December 31, 20X2, Pipe Ltd.

Q9: Which of the following consolidation adjustments will

Q10: On January 1, 20X3, Dwayne Ltd.

Q11: Coral Ltd. owns 100% of Ambrose

Q12: DC Company purchased 80% of the outstanding

Q13: Franklin Ltd., a subsidiary of Frayer