Essay

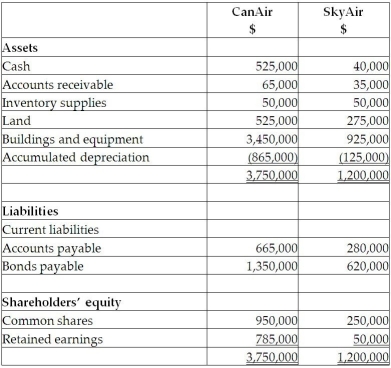

On September 1, 20X5, CanAir Limited decided to buy 100% of the shares outstanding of SkyAir Inc. for $500,000. Can Air will pay for this acquisition by using cash of $500,000. The balances showing on the statement of financial position for the two companies at August 31, 20X5, are as follows:  After a review of the financial assets and liabilities, CanAir determines that some of the assets of SkyAir have fair values different from their carrying values. These items are listed below:

After a review of the financial assets and liabilities, CanAir determines that some of the assets of SkyAir have fair values different from their carrying values. These items are listed below:

• The building has a fair value of $1,090,000. The remaining useful life of the building is 20 years.

• Internet domain name has a fair value is $55,000. The domain name is estimated to have a useful life of five years.

• Brand name has a fair value is $65,000 and an indefinite life.

During the 20X9 fiscal year, the following events occurred:

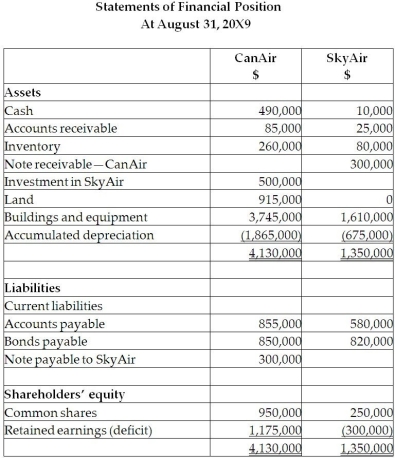

1. On March 1, 20X9, SkyAir sold land to CanAir for $390,000, which had a carrying value of $275,000. CanAir paid for this with $90,000 cash and a note payable for the difference. This note pays interest at 10%, which is paid monthly.

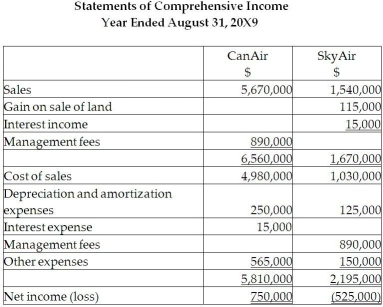

2. CanAir provided management expertise to SkyAir and charged management fees of $890,000.

3. CanAir sold supplies (included in CanAir sales)to SkyAir for $200,000. CanAir charged SkyAir an amount that was 25% above cost. SkyAir still has supplies on hand of $20,000.

4. In 20X8, SkyAir provided seat space on flights to Can Air for a value of $300,000. This amount was included in sales for SkyAir. Profit margin on these sales is 30%. At the end of August, 20X8, CanAir still had an amount of $150,000 in these prepaid seats that had not yet been used. (CanAir includes this in inventory.)

Required:

Required:

CanAir would like to report this investment in SkyAir using the equity method.

Determine the income from this equity investment for the year.

Determine the balance in the Investment in SkyAir account if the company used the equity method.

Correct Answer:

Verified

Correct Answer:

Verified

Q15: In consolidating parent-founded subsidiaries, what account is

Q16: Paranich Co. acquired Crowley Co. in a

Q17: Piri Ltd. acquired 100% of the commons

Q18: DC Company purchased 100% of the outstanding

Q19: Amber Ltd. acquired Luna Ltd. in a

Q21: Thivan Ltd. is a wholly-owned subsidiary

Q22: DIY Ltd. owns 20 subsidiary companies. Most

Q23: On December 31, 20X1, Dad Ltd.

Q24: What does "one-line consolidation" refer to?<br>A)Cost method<br>B)Equity

Q25: Goodwill impairment testing can involve comparing the