Essay

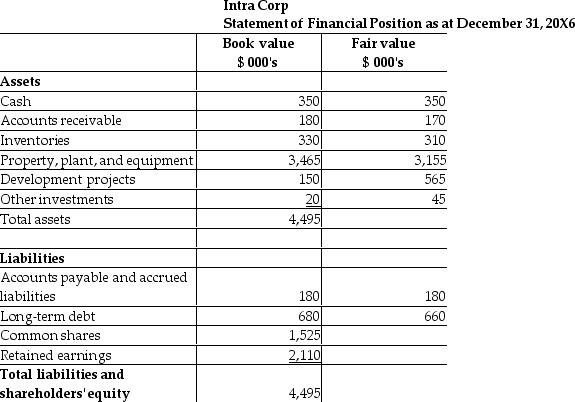

On January 1, 20X7, Falcon acquired the net assets of Intra for $3,400,000 with the issue of shares. The statement of financial position for Intra at the date of acquisition is shown below, together with estimates of the fair values of Intra's recorded assets and liabilities.

Required:

Required:

What is the amount of goodwill to be recorded for this business combination?

Prepare the journal entry that Falcon will use to record the business combination. Prepare the statement of financial position for Intra on January 1, 20X7, directly after the transaction is completed. Reconcile the book value of the retained earnings for Intra on December 31, 20X6, to its balance on January 1, 20X7. Explain any differences.

Correct Answer:

Verified

Calculation of goodw...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q8: At December 31, 20X0, Crowe Company has

Q9: Ha Ltd. and Hee Ltd. exchanged shares

Q10: There are a number of possible approaches

Q11: Which accounting method yields the same results

Q12: Sugar Corp and Syrup Limited have

Q14: Slade Co. has 1,000,000 shares outstanding and

Q15: How is negative goodwill reported on financial

Q16: <span class="ql-formula" data-value="\begin{array} { | l |

Q17: Thad Ltd. acquired 100% of the

Q18: <span class="ql-formula" data-value="\begin{array}{|l|r|r|r}\hline& \text { Cheers Co