Essay

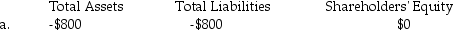

Given the following list of errors, determine the effect on assets, liabilities, and shareholders' equity by completing the chart below. Use (+) to indicate overstated, (-) to indicate understated, and (0) to indicate no effect. Transaction (a) is completed as an example.

a. The entry to record the purchase of $800 of equipment on account was never posted.

b. The entry to record the purchase of $100 of supplies for cash was posted as a debit to Supplies and a credit to Accounts Payable.

c. A $1,000 debit to Cash was posted as $100.

d. A $400 debit to the Accounts Payable account was never posted.

e. A debit to Accounts Receivable of $500 was posted as a credit to Accounts Receivable.

b.

b.

c.

d.

e.

Correct Answer:

Verified

_TB4002_00...

_TB4002_00...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q37: The following is a summary of the

Q40: An inexperienced accountant prepared the following trial

Q63: Receiving a payment from a customer on

Q80: The revenue account typically has a credit

Q82: On a trial balance the total of

Q98: All shareholders' equity accounts typically have a

Q99: The normal balance of an expense account

Q120: The ledger provides a good indication of

Q145: Use T-accounts to analyze the following transactions

Q147: State the decrease side (debit or credit)for