Essay

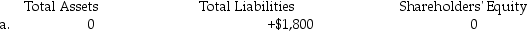

Following is a list of errors made during the posting process. Indicate the exact dollar impact each error would have on total assets, total liabilities, and shareholders' equity. Complete the chart below by using (+) to indicate overstated, (-) to indicate understated, and (0) to indicate no effect. Transaction (a) is completed as an example.

a. A $200 credit to the Accounts Payable account was posted as $2,000.

b. A $50 debit to Cash was never posted.

c. A $550 credit to the Revenue account was credited to the Accounts Receivable account.

d. A $45,000 debit to the Land account was debited to an expense account.

e. A $200 payment on an account payable was credited to Accounts Receivable instead of Cash.

f. A $350 debit to the Dividends account was posted as $530.

b.

b.

c.

d.

e.

f.

Correct Answer:

Verified

_TB4002_00...

_TB4002_00...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q10: Credits to revenue accounts ultimately result in:<br>A)

Q28: When the trial balance is out of

Q33: Dividends paid to the shareholders when declared

Q45: The normal balance of the Common Shares

Q48: A ledger is the first place where

Q67: Place a checkmark in the appropriate column

Q74: A trial balance that is "in balance"

Q110: Which type of account is credited when

Q130: When a company purchases inventory on account

Q133: A chart of accounts is:<br>A) prepared as