Multiple Choice

Answer the following questions using the information below:

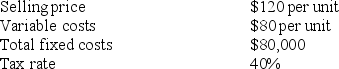

Assume the following cost information for Fernandez Company:

-If the tax rate is t, it is possible to calculate planned operating income by:

A) dividing net income by t

B) dividing net income by 1- t

C) multiplying net income by t

D) multiplying net income by 1- t

Correct Answer:

Verified

Correct Answer:

Verified

Q7: Mrs. Tannenbaum is going to sell Christmas

Q8: Breakeven point is that quantity of output

Q9: Cost-volume-profit analysis assumes all of the following

Q10: Answer the following questions using the information

Q12: The breakeven point in CVP analysis is

Q15: Answer the following questions using the information

Q16: Events, as distinguished from actions, would include:<br>A)personnel

Q19: Fixed costs _.<br>A) are considered variable costs

Q72: The difference between total revenues and total

Q85: The degree of operating leverage at a