Essay

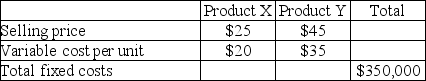

Atlanta Radio Supply sells only two products, Product X and Product Y.

Atlanta Radio Supply sells three units of Product X for each two units it sells of Product Y. Atlanta Radio Supply has a tax rate of 25%.

Atlanta Radio Supply sells three units of Product X for each two units it sells of Product Y. Atlanta Radio Supply has a tax rate of 25%.

Required:

a. What is the breakeven point in units for each product, assuming the sales mix is 3 units of Product X for each two units of Product Y?

b. How many units of each product would be sold if Atlanta Radio Supply desired an after-tax net income of $210,000, using its tax rate of 25%?

Correct Answer:

Verified

a. 3N = breakeven in product X 2N = brea...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q15: An increase in the tax rate will

Q44: Answer the following questions using the information

Q46: A planned increase in advertising would be

Q49: Answer the following questions using the

Q49: Answer the following questions using the information

Q50: A company with a low degree of

Q52: Ballpark Concessions currently sells hot dogs. During

Q53: Answer the following questions using the information

Q58: A profit-volume graph shows the impact on

Q82: Answer the following questions using the information