Multiple Choice

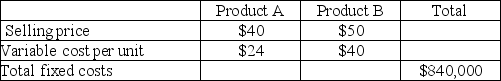

Mount Carmel Company sells only two products, Product A and Product B.  Mount Carmel sells two units of Product A for each unit it sells of Product B. Mount Carmel faces a tax rate of 30%. Mount Carmel desires a net after-tax income of $73,500. The breakeven point in units would be:

Mount Carmel sells two units of Product A for each unit it sells of Product B. Mount Carmel faces a tax rate of 30%. Mount Carmel desires a net after-tax income of $73,500. The breakeven point in units would be:

A) 21,750 units of Product A and 43,500 units of Product B

B) 22,500 units of Product A and 45,000 units of product B

C) 43,500 units of Product A and 21,750 units of Product B

D) 45,000 units of Product A and 22,500 units of Product B

Correct Answer:

Verified

Correct Answer:

Verified

Q10: Tom's Tire Tower, Inc., sells tires for

Q81: Answer the following questions using the information

Q82: Gilley, Inc., sells a single product. The

Q83: What would be the expected monetary value

Q84: If the selling price per unit is

Q85: Karen Hefner, a florist, operates retail stores

Q87: (CPA adapted, November 1992)The strategy most likely

Q88: Bassman Company operates on a contribution margin

Q146: Contribution margin = Contribution margin percentage ×

Q153: In CVP analysis,the number of output units