Essay

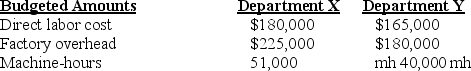

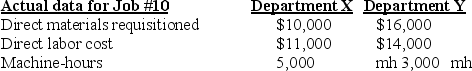

Jordan Company has two departments, X and Y. Overhead is applied based on direct labor cost in Department X and machine-hours in Department Y. The following additional information is available:

Required:

Required:

a. Compute the budgeted factory overhead rate for Department X.

b. Compute the budgeted factory overhead rate for Department Y.

c. What is the total overhead cost of Job 10?

d. If Job 10 consists of 50 units of product, what is the unit cost of this job?

Correct Answer:

Verified

a. $225,000/$180,000 = 125%

b. $180,000/...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

b. $180,000/...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q45: Work-in-Process Control will be decreased (credited) for

Q58: The actual indirect-cost rate is calculated by

Q79: The approach often used when dealing with

Q83: Overallocated indirect costs occur when the allocated

Q84: Give three examples of costs that can

Q86: Answer the following questions using the information

Q152: Normal costing assigns indirect costs based on

Q156: In the service sector, to achieve timely

Q194: Managers and accountants collect most of the

Q199: A _ links an indirect cost to