Multiple Choice

Answer the following questions using the information below:

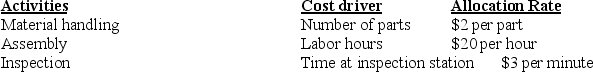

Nichols, Inc., manufactures remote controls. Currently the company uses a plant-wide rate for allocating manufacturing overhead. The plant manager believes it is time to refine the method of cost allocation and has the accounting department identify the primary production activities and their cost drivers:

The current traditional cost method allocates overhead based on direct manufacturing labor hours using a rate of $200 per labor hour.

The current traditional cost method allocates overhead based on direct manufacturing labor hours using a rate of $200 per labor hour.

-What are the indirect manufacturing costs per remote control assuming an activity-based-costing method is used and a batch of 100 remote controls are produced? The batch requires 500 parts, 10 direct manufacturing labor hours, and 5 minutes of inspection time.

A) $12.15 per remote control

B) $1215 per remote control

C) $24.30 per remote control

D) $48.60 per remote control

Correct Answer:

Verified

Correct Answer:

Verified

Q32: Logical cost allocation bases include:<br>A)cubic feet of

Q33: A company produces three products; if one

Q34: A key reason for using an ABC

Q35: Explain how activity-based costing systems can provide

Q36: Answer the following questions using the information

Q37: Answer the following questions using the information

Q39: Design of an ABC system requires:<br>A)that the

Q40: Premium Company provides the following ABC

Q40: Answer the following questions using the information

Q94: A well-designed, activity-based cost system helps managers