Essay

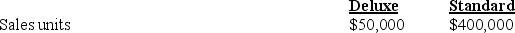

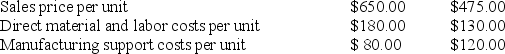

Come-On-In Manufacturing produces two types of entry doors: Deluxe and Standard. The assignment basis for support costs has been direct labor dollars. For 2010, Come-On-In compiled the following data for the two products:

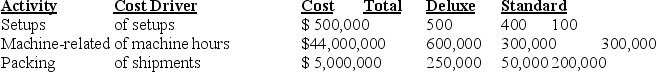

Last year, Come-On-In Manufacturing purchased an expensive robotics system to allow for more decorative door products in the deluxe product line. The CFO suggested that an ABC analysis could be valuable to help evaluate a product mix and promotion strategy for the next sales campaign. She obtained the following ABC information for 2010:

Last year, Come-On-In Manufacturing purchased an expensive robotics system to allow for more decorative door products in the deluxe product line. The CFO suggested that an ABC analysis could be valuable to help evaluate a product mix and promotion strategy for the next sales campaign. She obtained the following ABC information for 2010:

Required:

Required:

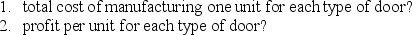

a. Using the current system, what is the estimated

b. Using the current system, estimated manufacturing overhead costs per unit are less for the deluxe door ($80 per unit)than the standard door ($120 per unit). What is a likely explanation for this?

b. Using the current system, estimated manufacturing overhead costs per unit are less for the deluxe door ($80 per unit)than the standard door ($120 per unit). What is a likely explanation for this?

c. Review the machine-related costs above. What is a likely explanation for machine-related costs being so high? What might explain why total machining hours for the deluxe doors (300,000 hours)are the same as for the standard doors (300,000 hours)?

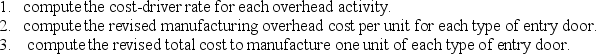

d. Using the activity-based costing data presented above,

e. Is the deluxe door as profitable as the original data estimated? Why or why not?

e. Is the deluxe door as profitable as the original data estimated? Why or why not?

f. What considerations need to be examined when determining a sales mix strategy?

Correct Answer:

Verified

a. Currently estimated deluxe-entry door...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q87: Answer the following questions using the information

Q88: Availability of reliable data and measures should

Q91: Activity-based costing helps identify various activities that

Q93: Answer the following questions using the information

Q94: How can the need for a more

Q95: Design costs are an example of:<br>A)unit-level costs<br>B)batch-level

Q96: Answer the following questions using the information

Q97: Answer the following questions using the information

Q98: ABC assumes all costs are _ because

Q143: Smaller cost distortions occur when the traditional