Essay

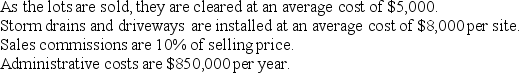

Johnson Realty bought a 2,000-acre island for $10,000,000 and divided it into 200 equal size lots.

The average selling price was $160,000 per lot during 20X5 when 50 lots were sold.

The average selling price was $160,000 per lot during 20X5 when 50 lots were sold.

During 20X6, the company bought another 2,000-acre island and developed it exactly the same way. Lot sales in 20X6 totaled 300 with an average selling price of $160,000. All costs were the same as in 20X5.

Required:

Prepare income statements for both years using both absorption and variable costing methods.

Correct Answer:

Verified

Cost of goods sol...

Cost of goods sol...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q9: Answer the following questions using the

Q71: Answer the following questions using the

Q109: Which of the following inventory costing methods

Q125: The higher the denominator level the higher

Q126: The following information pertains to Brian Stone

Q127: Absorption costing "absorbs" only fixed manufacturing costs.

Q128: Answer the following questions using the information

Q132: Under absorption costing,if a manager's bonus is

Q135: All of the following are examples of

Q143: Variable costing regards fixed manufacturing overhead as