Essay

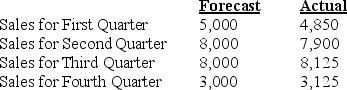

Marvelous Motors is a small motor supply outlet that sells motors to companies that make various small motorized appliances. The fixed operating costs of the company are $300,000 per year. The controlling shareholder, interested in product profitability and pricing, wants all costs allocated to the motors and wants to review the company status on a quarterly basis. The shareholder is trying to determine whether the costs should be allocated each quarter based on the 25% of the annual fixed operating costs ($75,000)or by using an annual forecast budget to allocate the costs. The following information is provided for the operations of the company:

Required:

Required:

a. What amount of fixed operating costs are assigned to each motor by quarter when actual sales are used as the allocation base and $75,000 is allocated?

b. How much fixed cost is recovered each quarter under requirement a.?

c. What amount of fixed operating costs are assigned to each motor by quarter when forecast sales are used as the allocation base and the rate is calculated annually as part of the budgetary process?

d. How much fixed cost is recovered each quarter under requirement c.?

e. Which method seems more appropriate in this case? Explain.

Correct Answer:

Verified

a. Rate per unit using Actual Sales by Q...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q11: The method that allocates costs by explicitly

Q46: Answer the following questions using the

Q63: When budgeted cost-allocation rates are used, variations

Q128: Answer the following questions using the information

Q129: Answer the following questions using the information

Q130: Answer the following questions using the information

Q131: The direct allocation method incorporates mutual services

Q134: When using the single-rate method, fixed cost

Q136: Which of the following departments is NOT

Q138: The step-down method allocates support department costs