Multiple Choice

Answer the following questions using the information below:

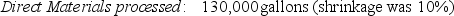

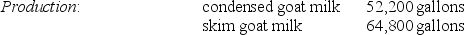

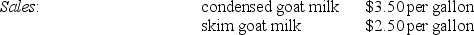

The Gows Company processes unprocessed goat milk up to the splitoff point where two products, condensed goat milk and skim goat milk result. The following information was collected for the month of October:

The costs of purchasing the 130,000 gallons of unprocessed goat milk and processing it up to the splitoff point to yield a total of 117,000 gallons of salable product was $144,480. There were no inventory balances of either product.

The costs of purchasing the 130,000 gallons of unprocessed goat milk and processing it up to the splitoff point to yield a total of 117,000 gallons of salable product was $144,480. There were no inventory balances of either product.

Condensed goat milk may be processed further to yield 39,000 gallons (the remainder is shrinkage) of a medicinal milk product, Xyla, for an additional processing cost of $3 per usable gallon. Xyla can be sold for $18 per gallon.

Skim goat milk can be processed further to yield 56,200 gallons of skim goat ice cream, for an additional processing cost per usable gallon of $2.50. The product can be sold for $9 per gallon.

There are no beginning and ending inventory balances.

-Using estimated net realizable value, what amount of the $72,240 of joint costs would be allocated Xyla and the skim goat ice cream?

A) $83,942 and $60,538

B) $88,942 and $55,538

C) $65,592 and $78,888

D) $144,480 and $72,140

Correct Answer:

Verified

Correct Answer:

Verified

Q9: The sales value at split-off method presupposes

Q27: What revenue or expense amounts are necessary

Q32: Define the terms main product, joint product,

Q41: List the reasons that the sales value

Q55: The constant gross-margin percentage method differs from

Q91: Answer the following questions using the information

Q92: If the sales value at splitoff method

Q98: The sales value at splitoff method is

Q99: Byproducts and main products are differentiated by

Q120: Distinguish between the two principal methods of