Essay

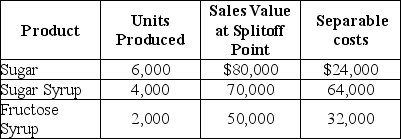

Sugar Cane Company processes sugar cane into three products. During May, the joint costs of processing were $240,000. Production and sales value information for the month were as follows:

Required:

Required:

Determine the amount of joint cost allocated to each product if the sales value at splitoff method is used.

Correct Answer:

Verified

Correct Answer:

Verified

Q26: All products yielded from joint product processing

Q27: What revenue or expense amounts are necessary

Q29: Wharf Fisheries processes many of its seafood

Q41: List the reasons that the sales value

Q55: The constant gross-margin percentage method differs from

Q85: The _ point is the juncture in

Q88: Products with a relatively low sales value

Q91: For each of the following methods of

Q91: Answer the following questions using the information

Q92: If the sales value at splitoff method