Multiple Choice

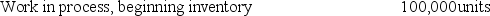

Ampco Disk Company operates a computer disk manufacturing plant. Direct materials are added at the end of the process. The following data were for August 20X5:  Transferred-in costs (100% complete)

Transferred-in costs (100% complete)

Direct materials (0% complete)

Conversion costs (90% complete)

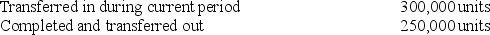

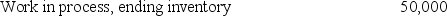

Transferred-in costs (100% complete)

Transferred-in costs (100% complete)

Direct materials (0% complete)

Conversion costs (65% complete)

Calculate equivalent units for conversion costs using the FIFO method.

A) 401,500 units

B) 350,000 units

C) 300,000 units

D) 292,500 units

Correct Answer:

Verified

Correct Answer:

Verified

Q25: Transferred-in costs are treated as if they

Q35: General Fabricators assembles its product in several

Q36: Answer the following questions using the information

Q38: Answer the following questions using the information

Q39: Universal Industries operates a division in Brazil,

Q42: Answer the following questions using the information

Q43: An operation costing system would be applicable

Q44: The first-in, first-out (FIFO)process costing method assigns

Q63: The weighted-average cost is the total of

Q85: In the computation of the cost per