Multiple Choice

Answer the following questions using the information below:

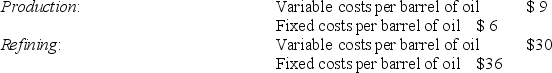

Penn Oil Corporation has two divisions, Refining and Production. The company's primary product is Luboil Oil. Each division's costs are provided below:

The Refining Division has been operating at a capacity of 40,000 barrels a day and usually purchases 25,000 barrels of oil from the Production Division and 15,000 barrels from other suppliers at $60 per barrel.

The Refining Division has been operating at a capacity of 40,000 barrels a day and usually purchases 25,000 barrels of oil from the Production Division and 15,000 barrels from other suppliers at $60 per barrel.

-Assume 200 barrels are transferred from the Production Division to the Refining Division for a transfer price of $18 per barrel. The Refining Division sells the 200 barrels at a price of $120 each to customers. What is the operating income of both divisions together?

A) $7,200

B) $7,800

C) $10,800

D) $20,400

Correct Answer:

Verified

Correct Answer:

Verified

Q54: Answer the following questions using the information

Q56: Section 482 of the U.S. Internal Revenue

Q58: An important advantage of decentralized operations is

Q60: The prices negotiated by two divisions of

Q61: Suboptimal decision making is also called congruent

Q62: Number of processes with real time feedback

Q63: A(n)_ is a binding agreement between a

Q64: Answer the following questions using the information

Q94: An advantage of using budgeted costs for

Q108: Cost based transfer prices are the only