Multiple Choice

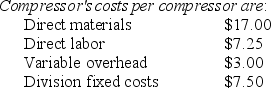

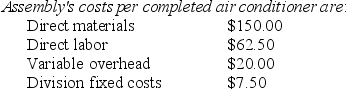

Answer the following questions using the information below:

Calculate the Division operating income for the Artic Air Company which manufactures only one type of air conditioner and has two divisions, the Compressor Division, and the Assembly Division. The Compressor Division manufactures compressors for the Assembly Division, which completes the air conditioner and sells it to retailers. The Compressor Division "sells" compressors to the Assembly Division. The market price for the Assembly Division to purchase a compressor is $38.50. (Ignore changes in inventory.) The fixed costs for the Compressor Division are assumed to be the same over the range of 5,000-10,000 units. The fixed costs for the Assembly Division are assumed to be $7.50 per unit at 10,000 units.

-Assume the transfer price for a compressor is 150% of total costs of the Compressor Division and 1,000 of the compressors are produced and transferred to the Assembly Division. The Compressor Division's operating income is:

A) $15,875

B) $16,375

C) $17,375

D) $18,250

Correct Answer:

Verified

Correct Answer:

Verified

Q65: The formal management control system includes shared

Q82: The costs used in cost-based transfer prices

Q104: Answer the following questions using the information

Q105: Answer the following questions using the information

Q106: For each of the following activities, characteristics,

Q107: Exertion towards a goal is:<br>A)motivation<br>B)effort<br>C)goal congruence<br>D)incentive

Q108: Optimal corporate decisions do NOT result when

Q110: A transfer price is the price one

Q112: Answer the following questions using the information

Q113: Answer the following questions using the information