Multiple Choice

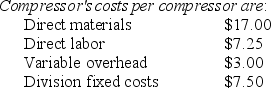

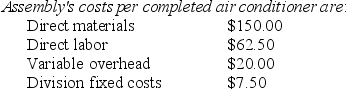

Answer the following questions using the information below:

Calculate the Division operating income for the Artic Air Company which manufactures only one type of air conditioner and has two divisions, the Compressor Division, and the Assembly Division. The Compressor Division manufactures compressors for the Assembly Division, which completes the air conditioner and sells it to retailers. The Compressor Division "sells" compressors to the Assembly Division. The market price for the Assembly Division to purchase a compressor is $38.50. (Ignore changes in inventory.) The fixed costs for the Compressor Division are assumed to be the same over the range of 5,000-10,000 units. The fixed costs for the Assembly Division are assumed to be $7.50 per unit at 10,000 units.

-If the Assembly Division sells 1,000 air conditioners at a price of $375.00 per air conditioner to customers, what is the operating income of both divisions together?

A) $100,250

B) $103,500

C) $97,000

D) $82,875

Correct Answer:

Verified

Correct Answer:

Verified

Q2: Autonomy is the freedom for managers at

Q3: Answer the following questions using the information

Q3: A company has a plant in a

Q4: A DISADVANTAGE of decentralization is that it:<br>A)creates

Q5: The Mill Flow Company has two divisions.

Q8: If the product sold between divisions has

Q9: Management control systems motivate managers and other

Q11: Answer the following questions using the information

Q44: A product may be passed from one

Q140: The president of Silicon Company has just