Multiple Choice

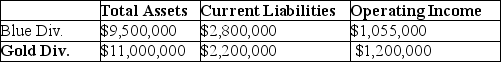

Springfield Corporation, whose tax rate is 40%, has two sources of funds: long-term debt with a market value of $8,000,000 and an interest rate of 8%, and equity capital with a market value of $12,000,000 and a cost of equity of 12%. Springfield has two operating divisions, the Blue division and the Gold division, with the following financial measures for the current year:  What is Economic Value Added (EVA®) for the Blue Division?

What is Economic Value Added (EVA®) for the Blue Division?

A) -$233,400

B) $21,960

C) $188,600

D) $433,960

Correct Answer:

Verified

Correct Answer:

Verified

Q20: Investment turnover is calculated as revenue divided

Q21: Designers of executive compensation plans emphasize which

Q22: Kase Tractor Company allows its divisions to

Q23: Springfield Corporation, whose tax rate is 40%,

Q24: The after-tax average cost of all the

Q27: Another name for return on investment is

Q28: If a company is a multinational company

Q29: Batman Abstract Company has three divisions that

Q30: A part of a control system that

Q129: Answer the following questions using the