Essay

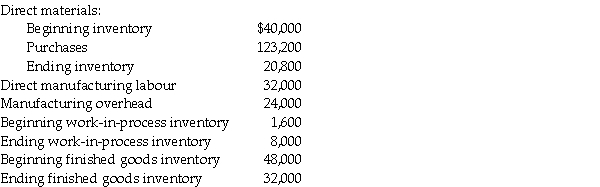

Evans Inc., had the following activities during 2012:

Required:

Required:

a. What is the cost of direct materials used during 2012?

b. What is cost of goods manufactured for 2012?

c. What is cost of goods sold for 2012?

Assume that Evans uses a two-part classification system for prime and conversion costs.

d. What amount of prime costs was added to production during 2012?

e. What amount of conversion costs was added to production during 2012?

Correct Answer:

Verified

a. $40,000 + $123,200 -$20,800 = $142,40...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q11: Use the information below to answer the

Q26: Answer the following question using the information

Q78: Use the information below to answer the

Q102: Generally, costs which are initially recorded as

Q132: "Cost" is defined by accountants as a

Q134: Which one of the following items is

Q145: Operating income does not include interest expense

Q155: What are the differences between direct costs

Q158: Use the information below to answer the

Q188: A unit cost is computed by dividing