Multiple Choice

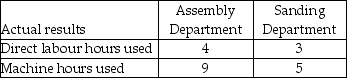

Babcock Industries uses departmental overhead rates to allocate its manufacturing overhead to jobs. The company has two departments: Assembly and Sanding. The Assembly Department uses a departmental overhead rate of $20 per machine hour, while the Sanding Department uses a departmental overhead rate of $15 per direct labour hour. Job 396 used the following direct labour hours and machine hours in the two departments:  The cost for direct labour is $25 per direct labour hour and the cost of the direct materials used by Job 396 is $1,200.

The cost for direct labour is $25 per direct labour hour and the cost of the direct materials used by Job 396 is $1,200.

What was the total cost of Job 396 if Babcock Industries used the departmental overhead rates to allocate manufacturing overhead?

A) $1,375

B) $1,425

C) $1,500

D) $1,600

E) $1,630

Correct Answer:

Verified

Correct Answer:

Verified

Q14: Outsourcing the accounting function is an example

Q51: Do activity-based costing systems always provide more

Q53: Answer the following question(s)using the information below.Wallace

Q67: Answer the following question(s) using the information

Q72: Using a department indirect cost rate to

Q74: Aunt Ethel's Fancy Cookie Company manufactures and

Q76: Cecelia Schell is taking four clients (who

Q79: Answer the following question(s)using the information below.Products

Q90: If a company undercosts one of its

Q105: Activity-based costing is not adaptable to merchandising